ARTICLE | May 09, 2024

“In this world, nothing is certain except death and taxes,” U.S. statesman Benjamin Franklin once wrote.

Despite the unpleasantness of the topic, nonprofits need to consider their donors’ mortality. Demographic and economic trends are set to culminate in a possible windfall for nonprofits in the near future.

You can’t take it with you

Nonprofits have developed several phrases to refer to postmortem contributions: planned giving, legacy gifts, and bequests. Fundraising professionals simultaneously acknowledge the importance of such contributions and the awkwardness of having conversations with donors.

Nevertheless, the death of donors is unavoidable. The American population is aging, with the percentage of those aged 65 and older expanding nearly every year in recent history. The U.S. Census Bureau projects an increase in annual deaths in the U.S. from 2.9 million in 2023 to 3.7 million in 2040—a number surpassing even the COVID-19-driven record of 3.5 million in 2021.

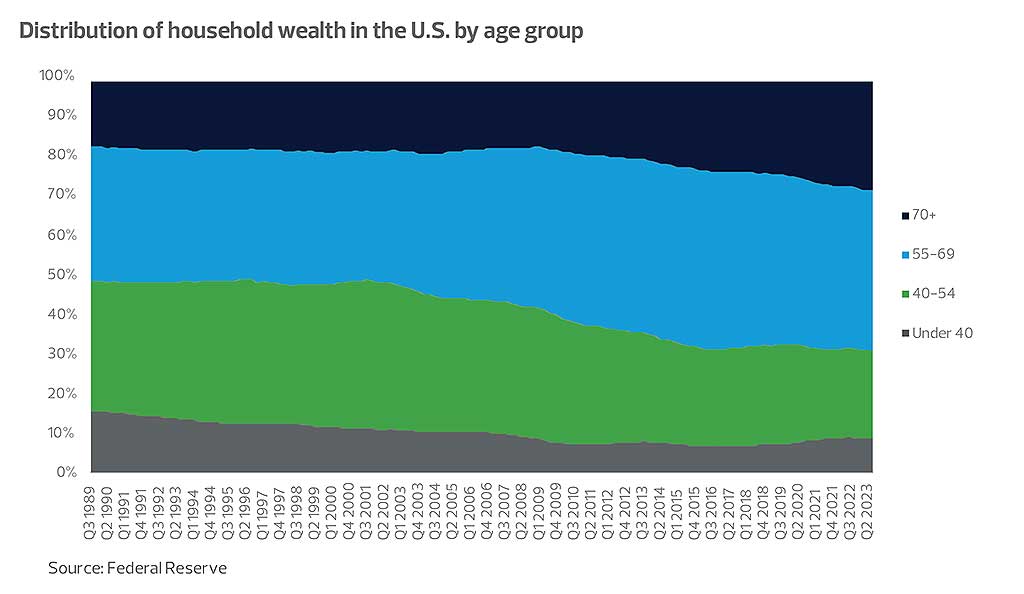

The baby boomer generation is not only shifting the median age of the U.S. older but also increasing that generation’s wealth. According to the Federal Reserve, individuals aged 55 or older hold two-thirds of the country’s household assets, and those 70 or older hold 28%. This amounts to $110 trillion and $45 trillion, respectively. So what is to become of this wealth at the passing of its holders?

According to Cerulli Associates, $84 trillion will be transferred through 2045. Of that, the researchers anticipate 14%, or almost $12 trillion, will be directed toward charitable use. This equates to average contributions of over $500 billion per year, a tremendous uptick from current levels. According to Giving USA, over the past five years, charitable contributions from individuals have averaged $317 billion per year.

Unrealized capital gains

American equity markets have historically been a winning long-term investment. In 2023 alone, market gains generated an estimated $900 billion of wealth for American households. However, those unrealized capital gains on households’ balance sheets can create significant capital gains tax liabilities upon the sale of the assets. Households don’t have the same opportunity for capital gain write-offs and deferrals that corporations do, so many Americans are discussing how to alleviate this pending burden.

Unsurprisingly, American households with the most wealth also hold the vast majority of shares in corporate equities and mutual funds. According to the Federal Reserve, at the end of 2024, the top 1% of the wealthiest households held nearly half of American households’ equities and mutual funds. That number expands to 87% when including the top 10% of wealthiest households.

Those top 10% of households have seen the value of their corporate equities and mutual funds increase by almost $20 trillion over the past 10 years. That is quite a pending tax bill. High-net-worth family offices and savvy financial advisors are well aware of the tax implications of these capital gains, and their strategies for mitigating tax liability may incorporate a significant amount of charitable giving.

The rapid rise of DAFs

Both human mortality and pending capital gains taxes are driving wealth holders toward charitable giving. But where is the money going?

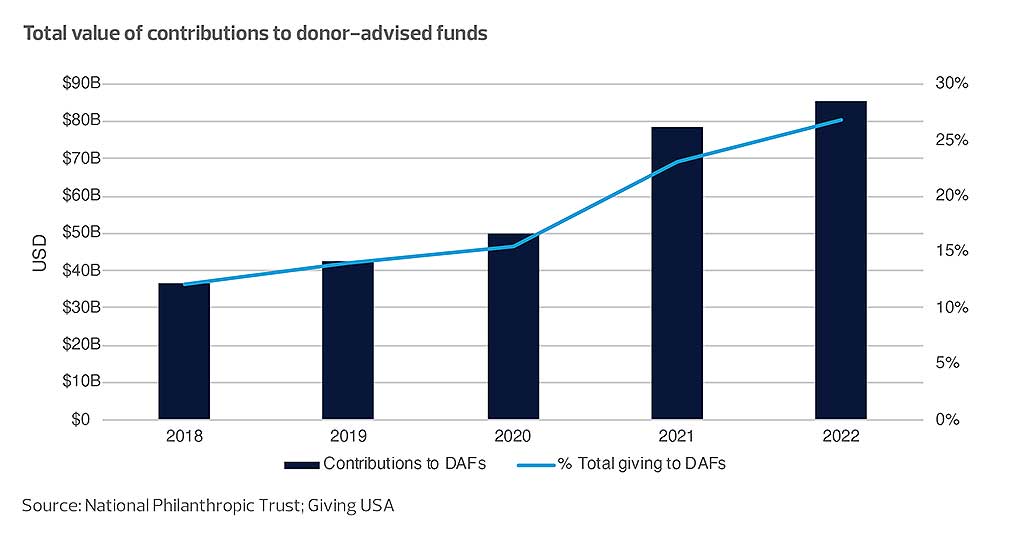

If recent trends continue—and we expect they will—donor-advised funds (DAFs) and, to a lesser extent, private foundations will be the recipients of most of these funds. We expect these types of intermediary organizations to balloon before funds flow more directly to operating charities.

DAFs are ripe for continued expansion as vehicles to address both death and taxes. Often more accessible than private foundations, DAFs provide an opportunity for end-of-life wealth transfer decisions. By establishing a DAF, individuals and households can ensure that a dedicated portion of their estate will be set aside for charitable use. Donors can identify advisors to recommend investments and distributions to specific charities.

Similarly, regarding taxes—in particular on appreciated assets—DAFs provide a ready alternative to traditional philanthropy. Other nonprofits may not have the interest in or the ability to receive noncash assets, especially closely held securities, so a DAF provides new opportunities for these types of gifts.

Most DAF sponsors have sophisticated complex-asset advisors, allowing them to readily accept noncash assets—from equities and mutual funds to cryptocurrency and real estate investment trusts. Moreover, because charitable contributions are nonrecognition events for tax purposes, donors will not be subject to tax on unrealized capital gains at the time of the donation. Although DAF sponsors will assume these unrealized gains, they generally are not subject to taxes when the assets are sold. The DAF can then make distributions to other charitable organizations, typically on the recommendation of the donor or donor-advisors.

Nonprofits should pay attention to the American trends of an aging population and significant capital gains exposure.

What can nonprofits do?

The optimal strategy for increasing charitable gifts will differ from the strategy of past decades. Nonprofits should pay attention to the American trends of an aging population and significant capital gains exposure. Opportunities in planned giving and donor-advised funds are significant and growing, while small-dollar donors and donations continue their downward trend.

Nonprofit fundraisers should engage with current donors on these two issues. How can you guide donors toward making legacy gifts and help direct their DAF disbursements to your organization? Donors are largely aware of these trends, so having direct conversations is critical for transparency and trust.

Fundraisers may also consider an increasingly popular, indirect approach. As wealth transfers become prevalent and DAFs grow, many individuals and households don’t yet have specific giving plans. This is where financial advisors and DAF sponsors can have significant influence. By engaging these entities rather than the donors themselves, nonprofits can position themselves for advisors’ recommendations, engaging with local financial firms and community foundations to find the most promising connections.

Nonprofits are always evolving, changing with the times to meet their missions. In the same way they approach fundraising, nonprofits need to acknowledge these trends and shift their strategies to take advantage of them. Current trends point toward record charitable giving in the next several years, and nonprofits should be positioned to receive it.

Let’s Talk

Fill out the form below and we’ll get back to you to discuss your specific situation.

This article was written by Matt Haggerty and originally appeared on 2024-05-09. Reprinted with permission from RSM US LLP.

© 2024 RSM US LLP. All rights reserved. https://rsmus.com/insights/industries/nonprofit/death-and-taxes-critical-opportunities-for-nonprofits.html

RSM US LLP is a limited liability partnership and the U.S. member firm of RSM International, a global network of independent assurance, tax and consulting firms. The member firms of RSM International collaborate to provide services to global clients, but are separate and distinct legal entities that cannot obligate each other. Each member firm is responsible only for its own acts and omissions, and not those of any other party. Visit rsmus.com/about for more information regarding RSM US LLP and RSM International.

The information contained herein is general in nature and based on authorities that are subject to change. RSM US LLP guarantees neither the accuracy nor completeness of any information and is not responsible for any errors or omissions, or for results obtained by others as a result of reliance upon such information. RSM US LLP assumes no obligation to inform the reader of any changes in tax laws or other factors that could affect information contained herein. This publication does not, and is not intended to, provide legal, tax or accounting advice, and readers should consult their tax advisors concerning the application of tax laws to their particular situations. This analysis is not tax advice and is not intended or written to be used, and cannot be used, for purposes of avoiding tax penalties that may be imposed on any taxpayer.